By ERIC MAUS, opinion contributor, The Hill

Thehill.com

President Biden has announced that the federal government will forgive $10,000 in student loan debt for Americans making less than $125,000 annually as well as extend the student loan repayment moratorium.

This plan is estimated to cost taxpayers $330 billion and should be seen as the most unfair, outrageous, and disgraceful decision in many years. The president is telling Americans that they do not have to bear any responsibility for their voluntary obligations in borrowing money or going into debt.

Forgiving student loans disproportionately benefits those with higher incomes. According to the Penn Wharton Budget Model, more than 70 percent of the debt forgiveness would be given to households who are in the top 60 percent of income distribution.

I somewhat disagree with this statement and will explain later. (scamming the system)

The president’s proposal will force middle and low-income Americans who have paid off their student loans or never attended college in the first place pick up the tab for higher-income Americans who decided to take on substantial student loan debt and have not yet fully paid off their loans.

Republicans and conservatives are not the only ones concerned about this fiscally reckless proposal. Larry Summers, an economic adviser to former President Barack Obama and secretary of the Treasury under former President Clinton, said “the student debt relief is highly regressive as higher income families are more likely to borrow and to borrow more than lower income families.

Adults with student loans have much higher lifetime incomes than those without.” Former Obama Council of Economic Advisors Chairman Jason Furman, said that forgiving student loan debt benefits recent college graduates at the expense of both the rich and poor.

He tweeted that it would be reckless to add gasoline on the inflationary fire and the loan forgiveness would go beyond the president’s campaign promise of $10,000 in student loan relief while violating his promise his proposals would be paid for.

In April 2022, House Speaker Nancy Pelosi (D-Calif.) said that President Biden does not have the power to forgive student loans. She is correct.

The White House’s plan to forgive student loan debt is just another example of Democrats completely shunning fiscal responsibility.

Almost immediately upon taking office, President Biden and Democrats in Congress authorized $1.9 trillion in the unnecessary and wasteful American Rescue Plan Act of 2021 (ARPA), which was followed by the $1.2 trillion Infrastructure Investment and Jobs Act (IIJA).

Just two weeks before his student loan forgiveness plan was announced, Congress passed and President Biden signed into law the so-called Inflation Reduction Act of 2022, which authorized $433 billion in new government spending and raised taxes by $739 billion.

I must ask. Are they simply trying to buy votes?

The unfairness of student loan forgiveness was highlighted in a series of articles that demonstrated the personal sacrifice made by tens of millions of Americans who took the responsibility to pay off their loans.

I did. I worked two jobs, while raising a family, and paid my own way through undergrad and graduate school. I graduated with no debt.

I was not alone. The article cites Michelle Schroeder-Gardner, who accumulated $40,000 in debt to obtain her master’s degree from the University of Missouri, and paid off her loan in eight months by working beyond her 40-hour weekly job.

Rutgers University graduate Pathik Oza had $70,000 in loans and started a used book business to earn enough income to pay it off within two years.

And a Florida couple who had a combined $203,000 in student loan debt set up a budget system that allowed them to pay it all off in 27 months.

Instead of congratulating and imitating these hard-working Americans who have demonstrated fiscal, personal, and moral responsibility, the White House is spitting in their faces along with everyone else who has paid off their loans or their children’s loans.

Citizens Against Government Waste has long been arguing against student loan forgiveness, including naming both Rep. Alexandria Ocasio-Cortez (D-N.Y.) and Education Secretary Miguel Cardona as Porkers of the Month for their support of this terrible idea.

This regressive plan would force those who never attended college or have paid off their loans to bail out those higher-income Americans who have failed to pay off their completely voluntary debts.

President Biden’s decision is both pandering to progressives and pushing for votes in the congressional elections in November 2022 and presidential election in 2024.

Well folks, let’s talk about something the previous article failed to mention.

Some people will say, fine, as long as they got a degree, I am ok with helping to pay for it. After all, we pay for public education even after our kids have graduated and continue to pay for k thru 12 for kids we will never know.

Well, that is a fine argument, but what if your money isn’t going to help someone get an education?

What Can You Use Student Loans For?

Written by Rebecca Safier, Ben Luthi, Jolene Latimer

Studentloanhero.com

Chances are, nobody is going to be watching your bank account to ensure you’re spending your loans on education expenses. That’s right, some students spend student loan money on things other than education.

In fact, A Student Loan Hero survey found that 20% of students use their student loan funds for travel and 26% use them for clothes. Only 10% use student loan funds just for tuition.

Students must have a place to live, food to eat, and a way to get to school; but they don’t need to spend an extravagant amount on entertainment, meals out, or trips with friends (spring break).

Students have been known to spend their student loan money on vacation travel, automobiles, clothes, expensive drinks and meals, business expenses, and even as a down payment on a home.

How do they pull this off? First you sign up for your student loans.

When the money is approved, it is put in the student’s account when classes start.

After classes start, the student can access the account. They then show up for the first week of classes and drop them.

They have met the obligation of attending class and now split with the money.

Now it is true, they still owe the money, but after pulling this scam for several semesters, they simply disappear with no intention of ever paying the loan back.

The key here is that college financial aid offices don’t actively monitor (or have the means to track) the student’s use of student loan funds.

What is a real shame is that many schools only have a limited amount of federal financial aid to dole out to its student body, which includes federal student loans.

If you are scamming the system, that could mean there’s less student loan funding available for a student who truly needs that money to pay for tuition.

How big of a problem is this?

Federal student loans make up the vast majority of American education debt—about 92% of all outstanding student loans is federal debt.

The federal student loan portfolio currently totals more than $1.6 trillion, owed by about 43 million borrowers. (Forbes.com)

I simply have to ask. How many of the people who took out student loans over the years simply saw it as free money and a way to cheat the system knowing they would never pay it back?

The second question I have is, Is the government simply using this tuition bailout to buy votes?

Well, how about a little history?

Huey Long

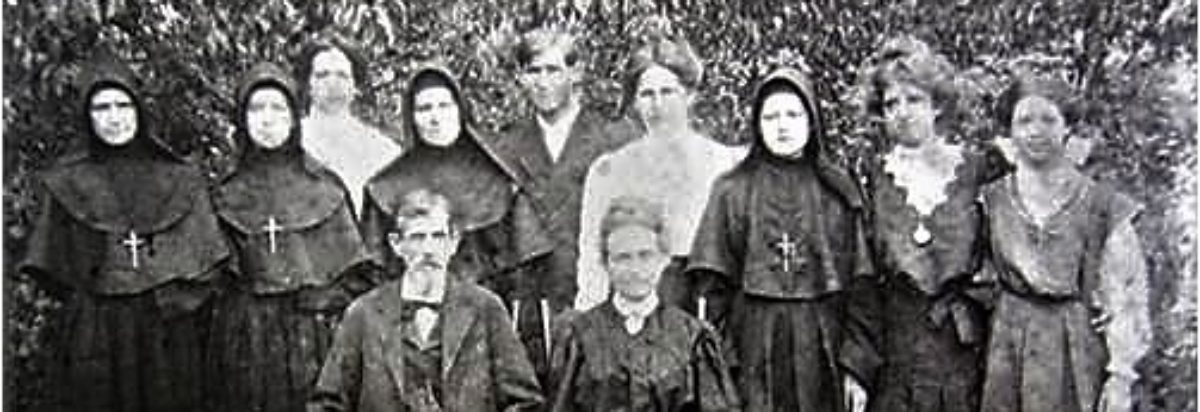

Huey Pierce Long Jr., nicknamed “the Kingfish,” was an American politician who served as the 40th governor of Louisiana from 1928 to 1932 and as a United States senator from 1932 until his assassination in 1935.

Share Our Wealth

In 1933, Long introduced a series of bills in the Senate that he called the “Share Our Wealth” program. Only a handful of senators supported the program, and Roosevelt did not. But public support for Long’s ideas began to pick up steam.

Seeking to build on that interest, Long mounted a nationwide campaign to promote what was essentially his alternative to the New Deal. Heorganized a networkofShare Our Wealthclubs that millions joined. He competed over the radio with Roosevelt’s “Fireside Chats.” In mid-1934, he was getting more mail than the president.

By early the following year, Long had spelled out more fully what Share Our Wealth would mean for the ordinary American. He was calling for benefits such as:

- a “fairly comfortable house,” car, and radio

- $5,000 guaranteed minimum wealth (about $90,000 in today’s dollars)

- a minimum annual income of about $2,500 (about $50,000 in today’s dollars).

- free education for every child through high school; and for anyone qualified, free college or vocational school

- a guaranteed job for all who could work

Economists soon pointed out flaws in Long’s plan. Share Our Wealth depended on taxing wealthy capitalists. But there were not enough millionaires in the U.S. (about 20,000 households in 1933) who would be the only ones taxed to fund Share Our Wealth.

The growing popularity of Long’s Share Our Wealth plan convinced him to challenge Roosevelt, a fellow Democrat, for the presidency in the 1936 election.

By the spring of 1935, Long was touring the country, drawing large audiences to his speeches.

On September 8, 1935, Long arrived in Baton Rouge to take part in a special legislative session when he was approached by Dr. Carl Weiss, the son-in-law of Judge Benjamin Pavy.

Pavy stood to lose his position during the session after Long revived a rumor about black children in the Pavy family to discredit him professionally.

Weiss shot Long at close range. Long’s bodyguards shot back at Weiss, killing him, while Long was rushed to the hospital where he died two days later of internal bleeding at the age of 44.

One can only imagine what might have happened had Long defeated FDR in the Presidential election of 1936.

FDR won that election by a landslide 523 to 8 Electoral votes over Alf Landon, the Republican candidate form Kansas.

Was Huey Long buying votes? You bet he was, and it was working.

Are Biden and the swamp buying votes? I will leave that up to you to decide.